Video Summary: How Capital One is Using Microsoft Technology to Prevent Fraud in a Digital World

Learn how Capital One is using technology to prevent fraud in a digital world and protect customers from identity theft. Insights from Capital One's Vice President of Fraud on the challenges faced by financial institutions and merchants.

As the world becomes increasingly digital, the risk of fraud has also increased, making it important to stay vigilant against potential identity theft and protect personal information.

In this interview, Jeffery York, CFO for Microsoft's Business Applications Division, speaks with Sarah Strauss, Senior Vice President of Fraud for US Cards, Capital One, about the challenges faced by financial institutions and merchants in the current environment, as well as the role of technology in preventing fraud.

We believe that sharing this video would be valuable because it offers insights into how financial institutions and merchants are using technology to protect customers from fraud, particularly as spending shifts towards card-not-present transactions.

3 Key Takeaways from this video:

1. Protecting personal information is essential to prevent identity theft.

2. As spending shifts towards card-not-present transactions, there is an increased risk of fraud.

3. Technology is at the core of preventing fraud in financial institutions and merchants.

FAQ:

1. What are some potential scams related to coronavirus?

Potential scams related to coronavirus include phishing scams, fake cures and treatments, and charity scams.

2. What are some strategies for protecting personal information?

Strategies for protecting personal information include using strong passwords, avoiding public Wi-Fi, and being cautious about sharing personal information online.

3. What is the role of technology in preventing fraud?

Technology is essential in preventing fraud because it enables financial institutions and merchants to quickly access and analyze data to detect potential fraud.

4. What are some common types of card-not-present fraud?

Common types of card-not-present fraud include account takeover, friendly fraud, and card-not-present skimming.

5. What is two-factor authentication?

Two-factor authentication is a security measure that requires users to provide two forms of identification to access an account, such as a password and a fingerprint.

This video was produced by Microsoft Dynamics 365, a suite of intelligent business applications that help organizations manage their finances, operations, sales, and customer service. The Microsoft Dynamics 365 YouTube channel features videos on topics such as digital transformation, innovation, and the latest trends in business.

Subscribe to our Newsletter

Subscribe to our blog and unlock a world of valuable insights, expert advice, and exclusive content. Join our growing community of subscribers and stay ahead of the curve with the latest trends, tips, and strategies. Don't miss out on this opportunity to elevate your knowledge and enhance your success. Subscribe now and embark on a journey of continuous learning and growth!

Heading

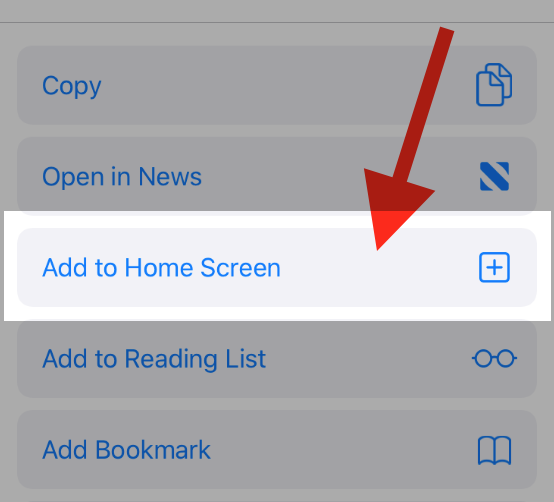

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

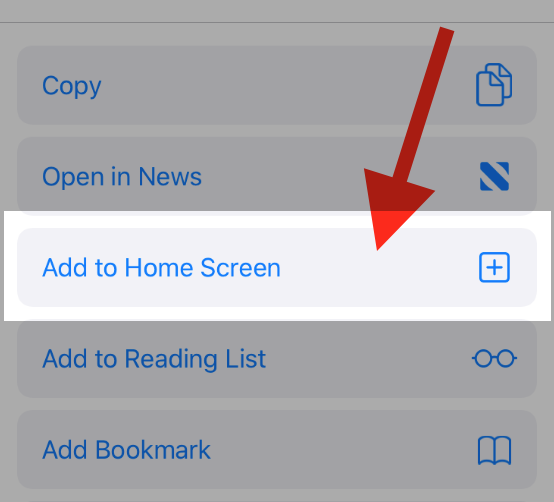

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!