Money! Is it here you got stuck?

IT Equipment Leasing: A Smart Financial Option for Your Business

What is IT Equipment Leasing?

IT equipment leasing is a financial agreement where a business can use IT equipment, like computers, servers, and software, from a leasing company for a set time period. The company makes regular payments, or lease payments, to the leasing company in exchange for using the equipment. When the lease term ends, the company can choose to buy the equipment, return it to the leasing company, or extend the lease for another period.

Leasing IT equipment allows companies to access the equipment they need without the initial expense of purchasing it outright. It also offers the flexibility to upgrade to newer equipment more frequently, which can be particularly beneficial for businesses that rely heavily on technology.

Advantages of IT Equipment Lease Financing

5 Key Benefits of IT equipment leasing for Small and Mid Size Businesses

1. Cost Savings

IT equipment leasing allows companies to obtain the use of necessary IT equipment without the upfront cost of purchasing it outright. This can be particularly helpful for small and mid-size companies with limited capital.

2. Flexibility

IT equipment leasing allows companies to upgrade to newer equipment more frequently, which can be important for keeping up with changing technology. This can be especially beneficial for small and mid-size companies that may not have the resources to continuously purchase new equipment.

3. Tax benefits

In some cases, IT equipment leasing may offer tax benefits, such as the ability to write off lease payments as a business expense.

4. Preservation of Credit

IT equipment leasing allows companies to obtain the use of necessary equipment without using up credit or tying up capital that could be used for other business purposes.

5. Customization

We often offer a range of lease options and customization to fit the specific needs and budget of a company. This can be particularly helpful for small and mid-size companies that may not have the same resources as larger companies.

Case Studies

There are many examples of companies successfully using IT equipment leasing to reduce costs. Here are a few examples:

Small business

A small business owner may choose to lease computers for their employees rather than purchasing them outright. This allows the business to obtain the use of necessary equipment without the full upfront cost of purchasing it, which can be especially beneficial for small businesses with limited capital, making it more manageable and allowing the company to use its capital for other purposes.

Mid-size company

A mid-size company may choose to lease servers for their data centre rather than purchasing them outright. This allows the company to spread out the cost of the equipment over the term of the lease, rather than paying for it all upfront, which can be more manageable for the company's budget. This allowed the company to obtain the necessary equipment without tying up capital, and also gave the company the flexibility to upgrade to newer equipment more frequently

Large corporation

A large corporation may choose to lease a fleet of laptops for their sales team rather than purchasing them outright. This allows the company to upgrade to newer laptops more frequently, which can be important for staying current with technology and ensuring that their sales team has the most up-to-date equipment to work with and preserve its credit and free up capital for other purposes and is able to lease the equipment instead of purchasing it outright.

IT Equipment Leasing Requirements by Us?

Below are the list of things that would be required to consider your company for IT Equipment Leasing

Basic financial information

- Company's credit score

- Latest and Past 2 Years' financial statements

- Last 6 Months' bank statements.

If Required, Personal Guarantee

We may also require a personal guarantee or collateral, such as a Fixed deposit.

Want to know more about IT Equipment Lease Financing?

If you are interested to know more about how we can customise your leasing requirements, please do contact us with your details.

Sample IT Equipment Lease Commercial Terms

Eligible Products: Range of laptops & desktops by Dell, HP & Lenovo

|

Customer Credit Rating |

BBB+ to A- |

A to AA |

Above AA |

|

Refundable security deposit |

10% |

10% |

10% |

|

PTPQ (Per Thousand Rupees (IT capital asset purchased) per quarter ) |

87.5 |

86.5 |

85.5 |

|

Tenor (quarters) |

12 Quarters Or 3 Years |

12 Quarters Or 3 Years |

12 Quarters Or 3 Years |

|

Payment terms |

Quarterly in advance |

||

For Eg: If your company is looking for buying IT Assets worth Rs. 25,00,000 in the next 1 year, then below is the amount payable as a Lease every quarter.

|

Customer Credit Rating |

BBB+ to A- |

A to AA |

Above AA |

|

Refundable security deposit @ 10% |

Rs.2,50,000/- |

||

|

Quarterly Lease Rental |

Rs. 2,18,750/- |

Rs.2,16,250/- |

Rs.2,13,750/- |

|

Tenor (quarters) |

12 Quarters Or 3 Years |

12 Quarters Or 3 Years |

12 Quarters Or 3 Years |

|

Total Amount Paid at the end of the tenor of 3 years |

Rs. 26,25,000 |

Rs. 25,95,000 |

Rs. 25,65,000 |

|

IRR Based on quarterly advance lease rental |

3.7% |

2.8% |

1.9% |

|

Payment terms |

Quarterly in advance |

||

Note:

1. Minimum Deal Size: Rs. 15,00,000 Only.

2. Fair Market Value (FMV)* lease for 3 years

Minimum Deal Size: Rs. 15,00,000 Only.

On the expiry of the leasing term: Lessee has the option to either extend the lease term, buy over the equipment at fair market value, or return the equipment to the funding partner in accordance with the terms of the leasing agreement.

What is IT Equipment Leasing Application Process?

Below is the process followed for any IT Equipment Leasing Requirements

Ascertaining the Requirements

Meeting with Stakeholders

Deciding the Leasing Partner

Obtaining and Reviewing of Financials and Credit Score

Checking of business history and industry reputation

Evaluating the equipment being leased and its potential resale value

If All Approved, Share the Master lease agreement to outline the terms and conditions of the lease.

Signing and Execution of the deal

Ordering and Delivering of IT Equipment

Considerations before leasing IT Equipment

When it comes to leasing IT equipment, there are several key factors that companies should consider to ensure a smooth and cost-effective experience.

Length of the lease term

First and foremost, it's important to carefully consider the length of the lease term and how it aligns with your business needs. A longer lease term can offer lower monthly payments, giving your company more financial flexibility. And, with the right equipment, you can rest assured that you'll have reliable technology to support your operations for the entirety of the lease term.

At the same time, a shorter lease term can offer greater flexibility, allowing you to upgrade to newer equipment more quickly. And, by avoiding the need to commit to outdated technology for an extended period, you can keep your business on the cutting edge.

End-of-lease options

It's also crucial to be aware of your end-of-lease options. With some leasing companies, you may have the option to purchase the equipment, return it, or renew the lease for an additional term. By understanding these options and selecting the one that best suits your business needs, you can ensure that your IT equipment continues to serve you well even after the lease term is up.

Maintenance and Insurance

We require you to purchase maintenance and insurance plans for ensuring proper upkeep and protection, but these requirements can actually be a benefit to your business too. By ensuring that your equipment is always in top working condition and protected from damage or theft, you can enjoy peace of mind and avoid unexpected expenses.

Early termination fees

It's important for you to be aware that your business needs may change over the course of the lease term. You should carefully consider whether the equipment you are leasing will still meet their needs by the end of the term, or if you will need to downgrade / upgrade equipment.

In case, you need a mid-course correction, an early termination fee shall be applicable. While early termination fees may be a consideration, these are often a small price to pay for the flexibility and convenience that leasing can offer to you

Understanding Total Cost of Ownership

When considering whether to lease or purchase IT equipment, it's important to understand the total cost of ownership. By factoring in ongoing costs such as maintenance and insurance, you can make an informed decision about which option is best for your business. And, with the right choice, you can enjoy reliable, cutting-edge technology that supports your operations and drives your success.

Heading

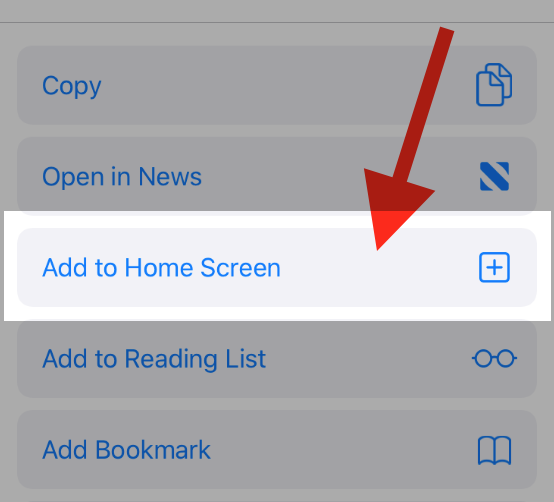

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

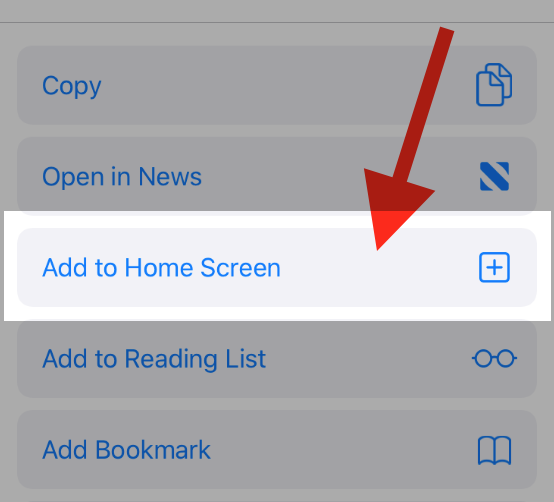

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!